Guidelines to Evaluate Funding Assistance for Unsolicited Project Developments

Overview

Unsolicited Project Assistance Requests are requests for project development assistance that are outside the CRA’s grant programs or Request for Proposals (RFP) process. The following document outlines guidelines for evaluating project, business, and development funding assistance requests.

Types of Project Assistance Funding CRA will consider

The Board will not consider funding for operational expenses, salaries, fees, or professional expenses, but the CRA’s funds should be invested in:

- Infrastructure improvements

- Building improvements

- Other physical investment in the proposed property—but tangible investments in real property

CRA Contribution Limits

The CRA will contribute (using multiple methods) a maximum of 15% of the total Project cost. However, applicants receiving this level of incentive support must demonstrate the highest level of need and economic impact (see below).

Projects to be Considered

Under the CRA Action Plan, priority consideration will be given for:

- Mixed-Use developments including housing, retail, office, and co-working space;

- High density mixed-use Transit Oriented Developments (TOD);

- Mixed-income housing projects, rather than exclusively low-income housing;

- Office and co-working development; ▪ Light industrial, assembly, food and agricultural processing;

- Destination retail, entertainment, arts, and cultural developments; or

- Restaurants will be considered only if they are part of a larger mixed-use or destination development.

Under no circumstances will the CRA fund:

- Liquor stores;

- Adult entertainment or adult product retail; nor

- Religious institutions. However, the CRA will consider projects of the types listed above developed by religious organizations.

Project Size Threshold

The unsolicited offer process is to be used for projects that are larger than its small business grant programs. The minimum size for projects to be considered for funding assistance are:

- 30 housing units or more;

- The creation of 15 new permanent jobs; and/or

- Delivering crucial services or products to CRA residents whose household income at or below the 2 bottom household income quintiles for Miami-Dade County.

Evaluation Criteria

The CRA will projects of the types listed above, based on how they achieve the following criteria, based on the CRA’s Goals.

Establish Need

The Project Developer or owner must establish a need for CRA funding assistance. Need for assistance my include, but not be limited to:

- Unanticipated or extraordinary unanticipated project physical costs;

- Unanticipated regulatory requirements that increase cost;

- Unanticipated market shocks (including global pandemics, material shortage, etc.) that negatively impact project economics; or

- The Project serves CRA residents demonstrating clear need, including low incomes, or a lack of essential services including education, training, jobs, and/or low incomes.

Building Local Human Capital

- For job creating projects 50 percent of the permanent jobs created by the Project must pay more than the Miami-Dade County median wage—currently $30,208

Addressing Housing Market Imbalances

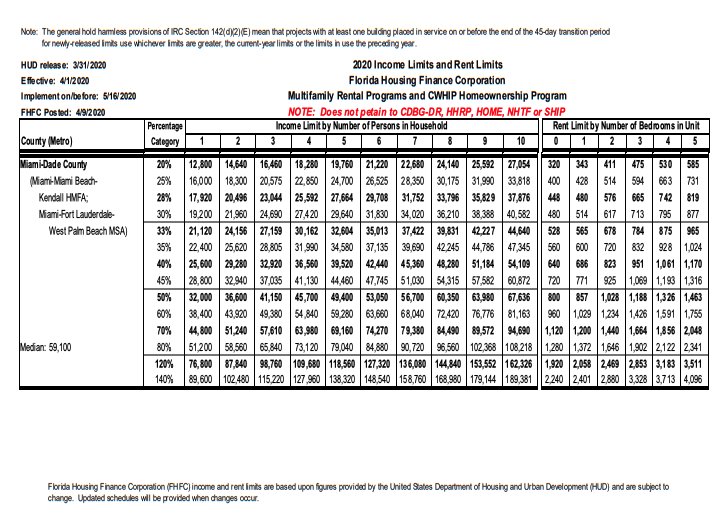

- A minimum of 25% of housing units developed in the Proposed Project units must be workforce affordable units. Workforce housing units are defined as those affordable to households earning 80-140% of the County Area Median Income, using HUD rental guidelines established and updated annually for Miami-Dade County.

- Housing units can be for rental or ownership

Reducing Traffic Congestion

The Project must demonstrate that it is reducing daily vehicle trips—commuting and/or local shopping. Developer must demonstrate that she is implementing strategies to reduce vehicular traffic including, but not limited to:

- Developer owner must establish that employment opportunities for residents of proposed housing units are available within a 1-mile radius of the project, at a ratio of 1 per household;

- Housing unit design that supports live-work, working from home, telecommuting, including a home office or workspace separate office space in housing units to support home-based businesses or telecommuting;

- Providing ultra-high-speed internet services and property-wide Wi-Fi to all project residents;

- Providing on-site shared office and/or co-working facilities within the project, available to residents;

- Showing proximity within ¼ mile, to mass transit. If Project is not within ¼ mile to mass transit, developer must show or provide access to shuttle service to nearby mass transit;

- The project or developer is providing, or providing access to, alternative transportation including shuttles, buses; ride-sharing, employer-sponsored park & ride support, employer-sponsored mass transit support for employees, or employer-sponsored shuttle service to mass transit

- Developer must show proximity to neighborhood retail and essential services, including grocery, healthcare and entertainment. If access to essential services are not within ½ mile of the project, developer must show availability of alternative (non-vehicular) shuttles and mobility services are available to residents of the project. Project will receive highest consideration if it provides alternative (non-automobile or shared auto) shuttle services to essential neighborhood services.

Environmental Sustainability

- Developer must demonstrate that the construction and operation of the project is reducing carbon emissions and supporting long-term environmental sustainability. Strategies may include, but not be limited to: using LEED-certified construction, retrofitting with high energy efficient system and equipment, or using or purchasing zero-carbon energy including wind and solar.

Expanding Economic Opportunity and Upward Mobility

- The Developer must show that the Project will be using Local hiring preferences (inside the boundaries of the CRA) for construction and permanent jobs created by the Project. Local hiring targets are 1) 30% of all construction jobs for residents of the CRA, 2) 25% of the total construction cost will be used to hire construction firms located within the CRA, and 3) 25% of all permanent jobs will be maintained for 5 years from the date of opening for CRA residents.

- Developer will in fact be required to enter into a Community Benefits with CRA legally requiring the Developer to meet the local hiring conditions.

Additional goals/considerations

- Supporting Local Innovation and Growing Competitiveness: if applicable, show how the Project helps support and/or create new businesses in the CRA, or provides technology or technical capacity for other businesses in the CRA to expand, grow market share, and/or compete in new markets.

- Does the project Support Upward Economic Mobility? Show how the project provides jobs and economic opportunities for CRA residents to gain employment, and advance their careers, with the Project business, or how it increases their skills to move up the employment ladder in the future.